us germany tax treaty summary

Germany taxes capital gains with the rate depending on the nature of the gain. Box 3 a fixed presumed gain of the market value of the Box 3 assets minus debt is taxed at a flat rate of 30.

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

While the US Germany Tax treaty is not the final word on how items of income will be taxed it does help Taxpayers better understand how either the US Government andor Germany will tax certain sources of income.

. Definition of USCanada Tax Treaty. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. As an American living abroad you receive an automatic two-month filing extension until June 15 and you can.

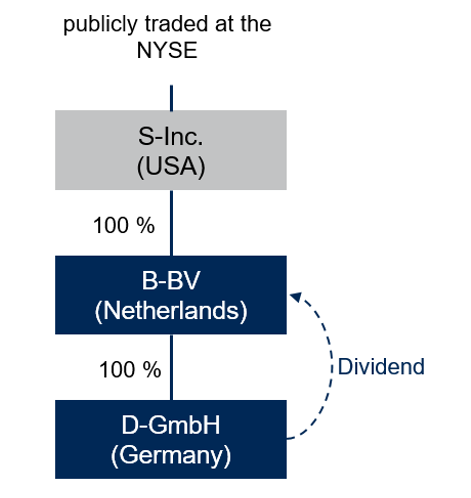

3 Relief From Double Taxation. Strong measures to prevent treaty shopping The United States branch tax prohibited under the existing convention will be imposed on United States branches of German corporations for taxable years beginning on or after January 1 1991. About Our International Tax Law Firm.

Us germany tax treaty summary. Under the treaty if a German decedent bequeaths the US. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income.

Germany - Tax Treaty Documents. A receives in the year 2018 his. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

9 Golding Golding. 400 dollars of self-employment income. 1 US-Germany Tax Treaty Explained.

Certain exceptions modify the tax rates. In the year 2040 the percentage will be 100. Us Germany Tax Treaty Summary germany summary United states and germany sign new protocol to income tax treaty summary on june 1 2006 the united states and germany signed a protocol.

Initially formed in the year of 1980 this mutual taxation agreement limits the duties between Canadian and US citizens and permanent residents that live in on the other side of the border. If an expat held less than 1 the entire capital. United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty.

The proposed anti-abuse provision is uniquely tailored to. Box 2 income is taxed at a rate of 25. 4 Income From Real Property.

98 rows Interest paid to non-residents other than on convertible or profit-sharing bonds and over-the-counter transactions is generally free of WHT. Tax treaties German national income tax law has been modified and superseded by various tax treaties with foreign countries to ensure that income is not taxed by more than one country. Article 11 2 provides a definition of the term interest.

In addition to this 50 exclusion the German decedents estate would receive a deduction of up to 12060000 for deaths occurring in 2022 on the remaining value. US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons. The complete texts of the following tax treaty documents are available in Adobe PDF format.

The Convention between the Federal Republic of Germanyand the United States of America for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to taxes on income and capital and to certain other taxes became effective on January 1st 1990 and is generally referred to as Germany-US. The German-American tax treaty has been in effect since 1990. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty.

Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in the other Contracting State. The minimum thresholds for filing in 2022 income received in 2021 are. Germany has concluded DTTs applicable for income taxes with nearly 90 countries amongst them most of the industrialised countries.

The protocol signed at berlin on june 1 2006 amended article 26 of the tax treaty between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes. In other words a Canadian citizen who is living in the US for a work placement wont need to face double taxation. Property to his or her German surviving spouse 50 of the value of the property is excluded from US.

8 Exchange of Information. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. 5 dollars of any income if youre married to a non-American but file separately.

For most types of income the solution set out in the Treaty for US expats to avoid double taxation in Germany is that they can claim US tax credits against German taxes that theyve paid on their income. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Most importantly for German investors in the United States the Protocol would eliminate the.

61 rows Summary of US tax treaty benefits. Individual Tax Rate Box 1 income is subject to progressive rates of 3665 up to 5175 with a 14 base deduction for entrepreneurs. 2 Saving Clause and Exceptions.

This percentage increases up to 2020 by 2 per year and from then on by 1. In the year 2005 only 50 of the payment was subject to German income tax. If an expat held a direct or indirect interest of 1 or more in a domestic or foreign corporation within the last five years 60 of the capital gain from the subsequent sale of shares is taxable.

Box 2 income is taxed at a rate of 25. Read More Canada Child Tax Benefit December Payment Date canada child. Corporate Income Tax Rate The corporate tax rates for 2019 are 19 on the first EUR 200000 of taxable profits and 25 on taxable profits exceeding EUR 20000.

The US-Germany tax treaty allows for improved tax transparency and information sharing between the two countries. 12550 US dollars of any income. The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax.

Tax on loans secured on German property is not imposed by withholding but by assessment to corporation tax at 15 plus solidarity surcharge of the interest income net of attributable expenses.

Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax

Us Expat Taxes For Americans Living In Germany Bright Tax

Us Expat Taxes For Americans Living In Germany Bright Tax

United States Germany Income Tax Treaty Sf Tax Counsel

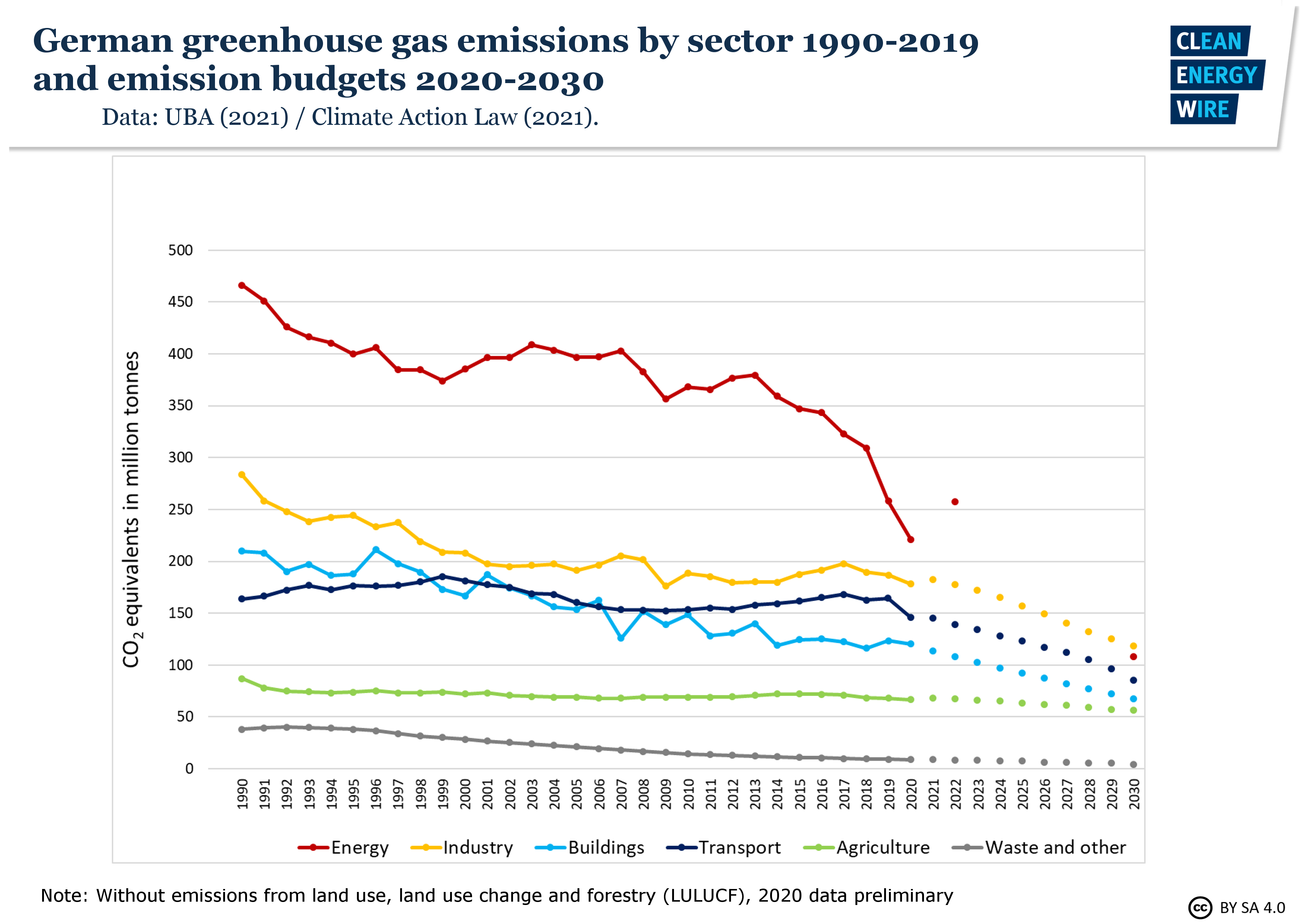

Germany S Climate Action Law Clean Energy Wire

Germany Usa Double Taxation Treaty

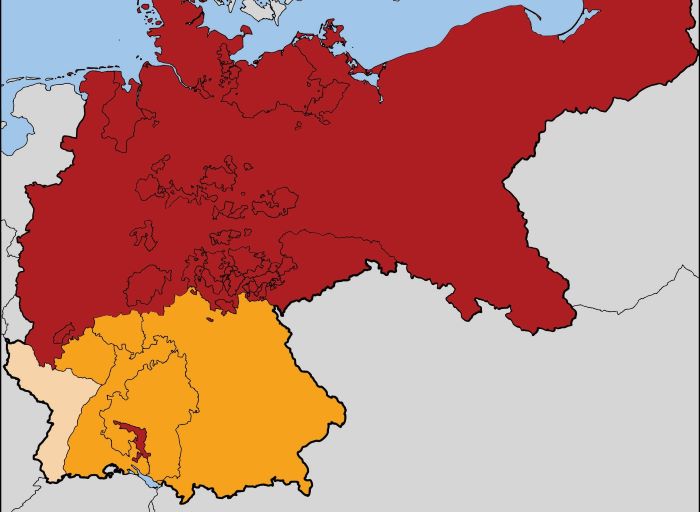

Read Bismarck And German Nationalism Article Khan Academy

Germany The Treaty Of Versailles Britannica

German Tax Advice For Smart Foreign Real Estate Investors Owners

What Is The U S Germany Income Tax Treaty Becker International Law

Crypto Tax Guide Germany 2022 Kryptowahrung Steuer 2022 Koinly

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

U S Loans Help Germany Pay Their Reparations From Wwi How To Plan German Propaganda Germany

German Tax Advice For Smart Foreign Real Estate Investors Owners

Income Tax In Germany For Foreigners Academics Com

Germany S Coalition Agreement Deloitte Legal Germany

Should The United States Terminate Its Tax Treaty With Russia